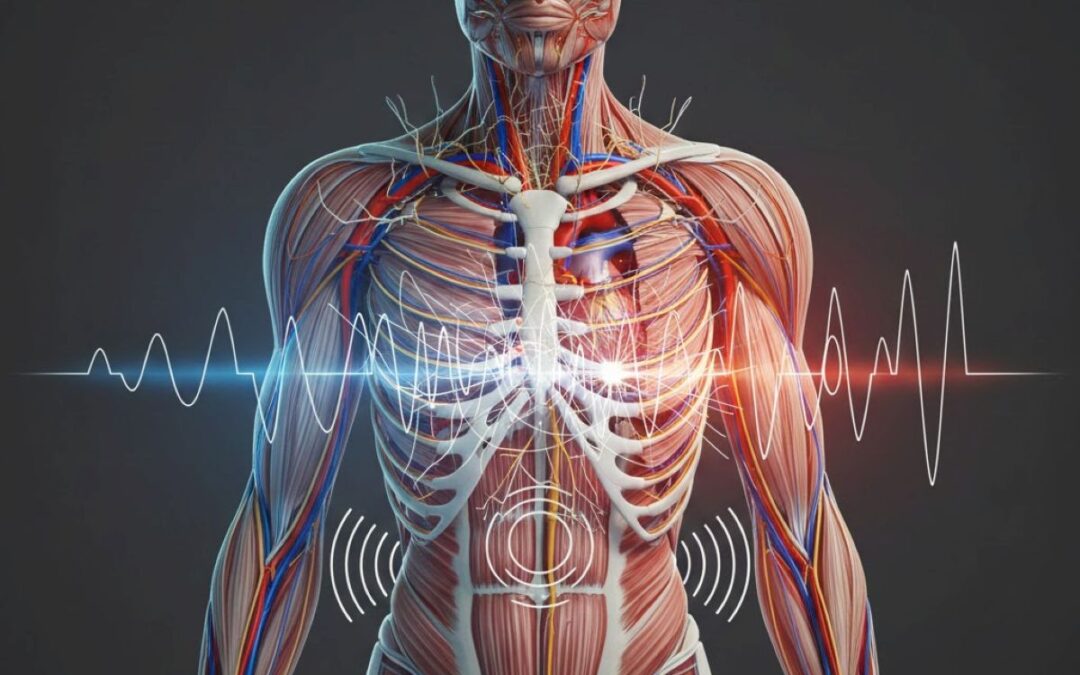

Medical imaging company Hyperfine, listed on the Nasdaq as HYPR, has announced the pricing of an underwritten public offering of 14 million shares of its Class A common stock at $1.25 per share, yielding gross proceeds of approximately $17.5 million before underwriting discounts, commissions and transaction expenses. The offering also grants the underwriter a 30 day option to purchase up to 2.1 million additional shares, representing around 15 percent of the firm shares, under the same terms. The company intends to use the proceeds for working capital and general corporate purposes, including commercial manufacturing and research and development of its portable magnetic resonance imaging technology.

Reasons behind the raise

Hyperfine is best known for its Swoop portable ultra low field brain MR system, designed to bring imaging to clinical settings beyond traditional hospital MRI suites. With the market for accessible imaging tools expanding and the company seeking to grow its commercial footprint, the new capital is expected to support manufacturing scale up and market expansion. The move also highlights Hyperfine’s need to strengthen liquidity as it continues to invest in production and regulatory initiatives. Raising $17.5 million at a share price of $1.25 implies some dilution to existing shareholders, suggesting the company is prioritising long term investment over short term balance sheet protection.

Key terms and structure

The offering covers 14 million shares at $1.25 per share, producing gross proceeds of $17.5 million. The underwriter holds an option to purchase an additional 2.1 million shares within 30 days. Hyperfine agreed to a 90 day restriction on further share issuance, while directors and executive officers committed to a 60 day lock up on their holdings. All shares in the offering are primary, meaning proceeds go directly to the company. Funds will be allocated to commercialisation, manufacturing, research and development, and general corporate purposes.

Market reaction and implications

Following the announcement, Hyperfine’s shares declined in after hours trading as investors reacted to the prospect of dilution and the company’s capital needs. While the raise increases liquidity, it also expands share count, reducing existing shareholders’ ownership percentage. For investors and analysts, the raise underscores two themes: Hyperfine’s ambition to accelerate adoption of its portable MRI system and its reliance on new capital to sustain that expansion. The market’s response indicates caution over the balance between growth prospects and financial sustainability.

Strategic outlook

Hyperfine’s public offering arrives at a pivotal stage for its portable imaging technology. Commercial scale up is central to its growth plan, with efforts to increase manufacturing, improve supply chain stability and expand into outpatient and mobile healthcare settings. Competition in portable imaging is intensifying, and differentiation through accessibility, cost and image quality will be crucial. The funds raised provide short term support for these objectives, though efficient deployment will be essential to maintain runway. Hyperfine must also navigate regulatory approvals, reimbursement pathways and potential pricing pressures as it advances its technology. Investor sentiment will likely hinge on whether the company can deliver meaningful commercial traction before needing additional funding.

Final thoughts

Hyperfine’s $17.5 million public offering represents a strategic move to fund expansion of its portable MRI technology while maintaining operational flexibility. It reflects both confidence in the long term potential of the Swoop system and the challenges of financing innovation in a competitive medtech market. While existing shareholders face dilution, the company gains critical resources to progress manufacturing, clinical adoption and research. The key test for Hyperfine will be demonstrating measurable progress in commercial performance and proving that this infusion of capital can sustain its momentum without further near term raises.