Danish pharmaceutical leader Novo Nordisk has made a dramatic late entry into the takeover race for United States biotech Metsera, challenging Pfizer’s earlier agreement and sparking a fierce bidding war in one of the most competitive areas of the life sciences market: obesity therapies.

The offers at stake and escalation

Pfizer originally agreed to acquire Metsera in September 2025 in a deal valued at approximately 7.3 billion US dollars, including about 4.9 billion up front and up to 2.4 billion in milestone payments. In late October, Novo Nordisk launched an unsolicited rival bid offering around 6 billion US dollars up front, with the total potentially rising to about 9 billion including milestones. Novo’s move effectively disrupted Pfizer’s previous agreement and positioned the Danish company as willing to pay a premium to secure Metsera’s pipeline of obesity and metabolic disease treatments.

Pfizer responded strongly, calling Novo’s bid reckless and questioning whether Metsera was legally free to engage with the rival offer under its existing agreement. Metsera, however, described Novo’s proposal as a superior company proposal and reportedly gave Pfizer a short window to improve its offer.

Why Metsera matters and why the timing makes this deal so strategic

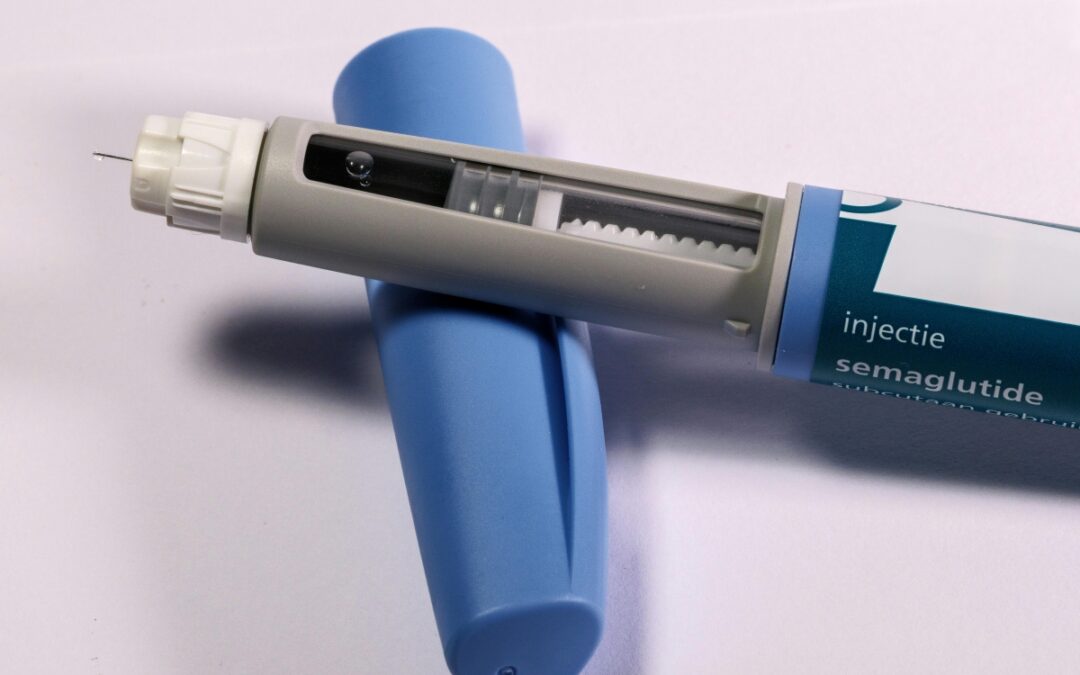

Metsera is a relatively young biotech company with no commercialised products yet, but its value lies in a promising pipeline of obesity and metabolism targeted therapies. These include a once monthly injectable GLP 1 agonist, MET 097i, and an amylin analogue, MET 233i, both in clinical development. The global obesity drug market is projected to reach between 100 and 150 billion US dollars annually by the early 2030s, driven by new drug approvals, expanding treatment indications and growing patient demand.

For Novo Nordisk, the acquisition would reinforce its dominance in obesity and metabolic diseases, areas where its flagship drugs such as Wegovy and Ozempic already lead the market. The company also faces increasing competition from Eli Lilly and approaching patent expirations, making new assets highly attractive. Pfizer, meanwhile, views Metsera as an opportunity to re establish its presence in obesity medicine after earlier setbacks in its internal development programmes.

The timing of Novo’s offer is significant. It came shortly after a change in its leadership and board, amid shareholder pressure to act more aggressively in the obesity market. This suggests the move is both a strategic acquisition and a signal to investors that Novo intends to remain the industry’s market leader.

Despite the excitement surrounding the deal, risks remain. For Novo, the higher valuation places pressure on future performance and integration success. For Pfizer, the existing agreement could result in legal disputes if Novo proceeds, since Pfizer has stated that it will pursue all legal avenues to enforce its rights under the signed deal.

Regulatory scrutiny is also likely. Pfizer has argued that Novo’s offer could be anti competitive, given its dominant market position in obesity drugs, and suggested that antitrust authorities might intervene. Meanwhile, Metsera’s pipeline remains in mid stage development, meaning that much of the company’s valuation depends on future milestones and contingent value rights, which could change if clinical results do not meet expectations.

Commercial and strategic implications for the market

If Novo Nordisk succeeds in acquiring Metsera, the deal would strengthen its leadership in obesity and metabolic disease therapeutics, expand its pipeline and provide additional long term growth. For Pfizer, losing the asset or being forced to raise its bid could alter its obesity strategy and delay its re entry into a market that has rapidly become one of the most profitable in pharmaceuticals.

For Metsera’s shareholders, the situation is favourable, as the bidding war has boosted valuation and leverage. For the broader obesity drug market, this contest signals accelerating consolidation and rising deal valuations. For patients, competition between Novo and Pfizer could ultimately lead to faster access to new treatments, although increased pricing and reimbursement scrutiny may follow.

In the coming weeks, the main questions will be whether Pfizer will raise its offer, whether Novo can secure regulatory approval, and how Metsera’s board will navigate the competing interests. The outcome could shape the competitive landscape for years to come.

Regardless of who prevails, the bidding war highlights how central obesity and metabolic disease therapies have become to global pharma strategies. Novo Nordisk’s aggressive move and Pfizer’s defensive stance illustrate the growing importance of this therapeutic area and the high stakes involved in capturing future market share.