The commercial real estate market serving the life sciences industry is currently undergoing a complex period of adjustment. The underlying dynamics that once propelled rapid growth, such as enthusiastic venture capital, strong demand from biotech and pharmaceutical tenants, and aggressive speculative development, are now colliding with headwinds including oversupply, elevated costs, tighter capital, and shifts in technology and occupier behaviour. This article explores the key obstacles shaping the sector today and what they mean for developers, investors, and occupiers alike.

Oversupply and Weak Absorption

One of the most significant pressures in the life sciences real estate sector is the imbalance between supply and demand. Research by JLL indicates that a surge of new laboratory and R&D space is being delivered, especially in core US markets such as Boston, Cambridge, the San Francisco Bay Area, and San Diego (JLL). The US market has recorded negative net absorption in multiple consecutive quarters, with vacancy rates reaching levels rarely seen in this specialised asset class (Newmark).

In the UK, leasing volumes improved in the first half of 2025, yet investor appetite remains subdued due to high valuations and weaker occupier activity (CBRE). The outcome is increasing pressure on rents, greater incentives being offered, and an elevated risk of further value erosion.

Cost Pressures: Construction, Interest Rates and Fit Out

While supply is abundant, the cost of developing and operating life sciences real estate remains elevated. Laboratory and research space requires high levels of capital investment due to strict technical specifications, including ventilation, power capacity, and safety standards. Cushman & Wakefield reports that the development pipeline has slowed considerably, with many projects deferred beyond 2025 as developers take a more cautious stance (Cushman & Wakefield).

At the same time, high interest rates and construction costs have made financing more expensive. Fit out costs for laboratories remain significantly higher than for conventional offices, discouraging smaller biotech firms from committing to long-term leases. In response, many landlords now offer rent-free periods, extended fit-out times, and flexible leasing structures to attract tenants. The cumulative effect has been longer leasing cycles and more conservative project assumptions.

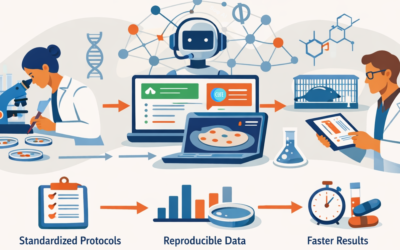

Shifting Occupier Needs and Technological Change

The profile of occupiers in the life sciences sector is changing rapidly. Advances in artificial intelligence, automation, and computational biology have altered the type of space required by tenants. According to JLL, AI-focused life sciences companies lease about one third less space than traditional biotech firms, preferring modular and flexible configurations (JLL).

An industry executive noted,

“AI-native companies are pioneering new models of space utilisation that emphasise computational power, automation, and adaptability.”

This has left some landlords with large, highly specified laboratories that no longer align with occupier demand. Even when funding is available, many early-stage biotech firms are cautious about expansion, keeping overall demand roughly 60% below its 2021 peak.

Capital Markets and Investor Sentiment

Investor confidence in life sciences real estate has weakened. In the UK, CBRE’s mid-year review for 2025 noted subdued transaction volumes and persistent pricing gaps between buyers and sellers (CBRE). In the US, capital inflows are stabilising, but oversupply, rising cap rates, and weaker rent growth have caused investors to re-evaluate returns. According to WebProNews, average vacancy rates across major life sciences hubs have risen to historic highs (WebProNews).

Owners who purchased at peak valuations or relied heavily on debt now face potential valuation declines and limited refinancing options. These pressures are likely to persist until new demand catches up with available inventory.

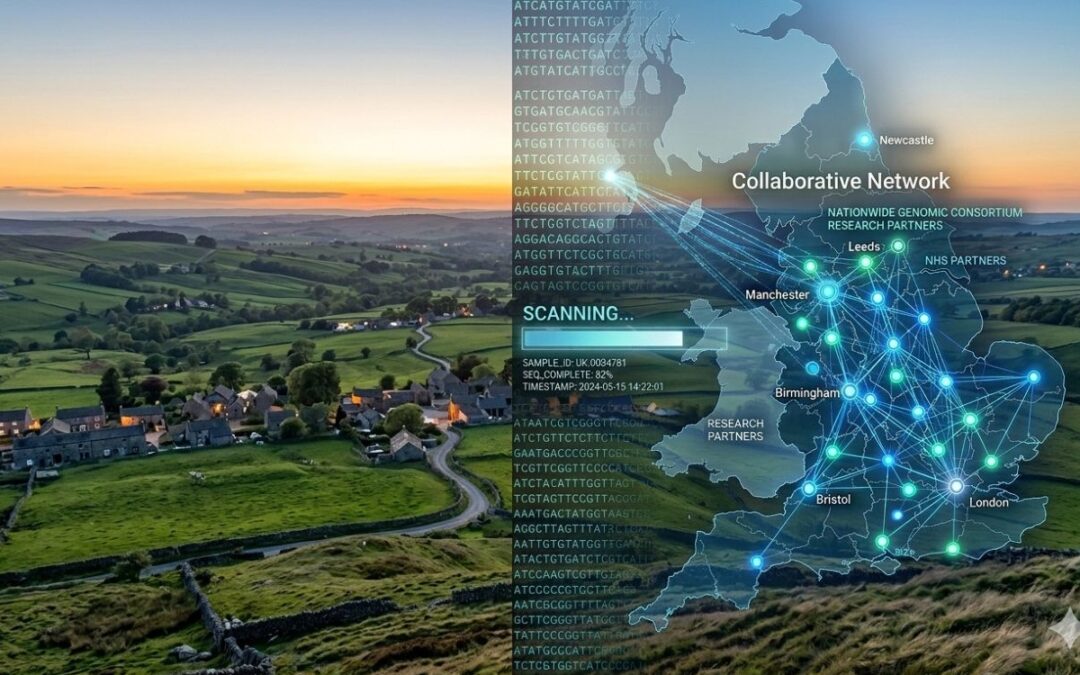

Geographic Concentration and Funding Risk

The global boom in life sciences real estate has been heavily concentrated in a small number of markets, including Boston, Cambridge, San Francisco, San Diego, and the Oxford–Cambridge–London corridor. This concentration has amplified vulnerability as tenant demand moderates. Some US markets are now reporting availability rates above 30% (WebProNews).

Venture capital investment, which historically fuelled growth in the sector, has also softened. Cushman & Wakefield’s 2025 report notes that biotech funding has declined to pre-pandemic levels (Cushman & Wakefield). With fewer start-ups seeking new space, landlords are increasingly reliant on larger pharmaceutical companies, many of which are consolidating or downsizing rather than expanding.

Design, Sustainability and Adaptability

Life sciences facilities are among the most complex and expensive asset types to build and manage. Laboratory spaces require reinforced structures, advanced HVAC systems, vibration control, and specialised waste management. These factors make conversion to alternative uses both technically challenging and costly. JLL estimates that up to 18.7 million square feet of lab space may need repurposing by 2030 (JLL).

Sustainability adds another layer of complexity. Both investors and occupiers increasingly demand net-zero carbon buildings and environmentally responsible designs. Meeting these standards raises upfront costs but is crucial for maintaining asset competitiveness. Failure to do so could leave owners with stranded or underperforming assets in a market increasingly guided by ESG principles.

Strategic Implications and Outlook

To navigate this transition, developers, investors, and occupiers must rethink traditional strategies. Developers should pivot away from speculative projects towards pre-leased or build-to-suit models aligned with occupier needs. Investors must stress-test assets against longer lease-up periods, slower rent growth, and potential conversion scenarios.

Occupiers currently hold greater negotiating power and should secure flexibility within leases, such as phased occupancy or options for expansion. Secondary markets outside traditional clusters may also gain momentum as tenants seek lower costs and less competition for space.

Asset owners who prioritise flexibility and adaptability will likely outperform. As one industry analyst told Commercial Observer,

“The worst may be behind us, and we are heading into 2025 in a stronger position than the year before” (Commercial Observer).

Despite the near-term challenges, long-term fundamentals remain positive. Governments in the UK and Europe continue to support life sciences through policy incentives, research funding, and infrastructure investment. The industry’s resilience will depend on how effectively real estate stakeholders adapt to these evolving structural shifts.