How Modular Hardware Is Breaking Decades of Vendor Lock-In

There’s a running joke among biotech lab managers that goes something like this: You don’t buy a bioreactor. You buy a relationship. A very expensive, very locked-in relationship. It’s funny because it’s painfully true.

For decades, when you committed to one manufacturer’s bioreactor, you didn’t just get hardware – you got shackled to their entire ecosystem. Their sensors. Their proprietary software. Their consumables. Their upgrade path. Want to swap in equipment from another vendor? Better hire a consultant and prepare your budget for a painful integration project that’ll drain both your time and resources. For labs operating on tight margins or ambitious timelines, this inflexibility isn’t just annoying – it’s a genuine innovation killer.

But what if biotech labs could operate more like how the rest of us use technology? Plug and play. Mix and match. Upgrade without overthinking it. Scale up gradually instead of betting the farm on one monolithic system. No vendor lock for data – you always have full access to your own process data.

That’s the premise behind QB Systems, a modular bioprocess automation platform built by the Polish company A4BEE. And after reviewing their technical documentation and market positioning, it’s clear they’ve identified a real pain point that the industry’s incumbents have largely ignored.

The Real Problem: Biotech’s Infrastructure Headache

Let’s start with what everyone in the industry knows but few openly discuss. Integrating lab automation is expensive and rigid – precisely when labs need to be flexible most. When a pharmaceutical company wants to shift from mammalian cell cultures to bacterial fermentation, or when a startup needs to pivot its manufacturing strategy halfway through a Series B round, the last thing you need is a system that forces you to scrap thousands of dollars in equipment and start from scratch.

Data fragmentation compounds the pain. Each piece of equipment generates data in its own format using its own protocol, and labs end up spending more energy troubleshooting integration issues than advancing research. A typical automation setup across multiple vendors can involve custom software layers, middleware solutions, and ongoing technical debt. For smaller labs, this often means hiring engineers just to keep the infrastructure humming.

The capital investment is brutal too. A fully integrated lab automation system can easily run $1 million or more, and that’s before you factor in the hidden costs: validation, training, downtime during installation, and the opportunity cost of diverting resources away from science. Startups with 5-20 people operating on Series A funding can’t absorb this risk. Even mid-sized biotech firms find themselves forced to choose between innovation and fiscal responsibility.

Enter QB Systems: Lego Blocks for Serious Science

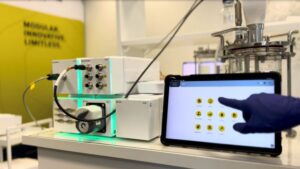

QB Systems’ core product consists of two layers: QB Modules (the hardware) and QB Control (the software platform).

The architecture is deliberately modular – think Lego blocks for bioreactors. – says Klaudia Kozusznik, QB Systems Head of Growth.

On the hardware side, QB offers a variety of plug-and-play components: pumps in different configurations (peristaltic, centrifugal, syringe), multi-sensor data acquisition devices, gas flow controllers, agitators, vessels, and… much more. There is even a custom-designed foam and liquid level sensor!

The real differentiator is what they’ve built into the software layer.

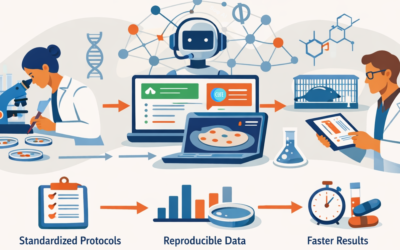

QB Control is designed as an integration platform – not a closed silo. It can connect to existing equipment from other vendors using standard industrial protocols: OPC-UA,

Modbus, MQTT. Labs aren’t forced to rip and replace. They can bolt QB Control onto their existing setup, retrofit legacy systems, or build an entirely new operation from scratch.

The flexibility is intentional. – says Krzysztof Kaczor, QB Systems CEO

Why this matters…

QB Systems positions itself as superior on two fronts: flexibility and cost performance. While established competitors like Sartorius (AMBR), Eppendorf, and Thermo Fisher dominate in sheer automation and parallel processing capability, they do so at a premium. QB’s strategy is clever – they’re not trying to beat the incumbents at their own game. They’re changing the game.

Their real advantage isn’t raw features. It’s that the same physical modules can be reused across different system configurations. The same pump that services a bioreactor setup can later be pressed into media preparation duty or filtration control without redundant hardware. This is hardware reusability at scale – something most vendors explicitly engineer against, because redundancy is what drives repeat sales.

A global problem (with a global solution)

Here’s something underreported: QB was born out of necessity. A4BEE, the company behind QB Systems, spent years running laboratory digitization projects for clients across Europe, the U.S., and beyond. The common thread? Integration hell. Consultants, custom middleware, workarounds. Eventually, leadership made a decision: stop solving the problem for individual clients and build a universal solution.

They’ve already deployed systems in real-world scenarios: full bioreactor setups for mammalian cell production at European biotech firms, perfusion chamber configurations for universities, algae and yeast manufacturing setups with direct sensor integration. These aren’t hypothetical deployments. They’re running production.

What lab managers should actually know

If you’re running a biotech lab and this resonates – whether you’re in a startup, a contract development or manufacturing organization (CDMO), academia, or an established pharma firm – the practical implication is worth examining:

QB Systems offers something the incumbents largely don’t

- the ability to build exactly the setup you need without purchasing capabilities you don’t, and without binding yourself to a single vendor for the next decade.

- modular architecture that means you can start small, prove ROI, and scale gradually.

- the software platform that removes data fragmentation by centralizing everything in one system. The regulatory compliance is baked in from day one, not bolted on as an afterthought.

The bottom line

Biotech labs have tolerated vendor lock-in for so long that many have forgotten it’s a choice, not an inevitability. QB Systems isn’t the first modular bioprocess platform to challenge the status quo, but they’re the first I’ve encountered that seems to have genuinely internalized the lesson: scientists shouldn’t waste time managing infrastructure. They should do science.

Whether QB captures meaningful market share against Sartorius and their peers will depend less on technical merit (they appear to have that) and more on whether labs can overcome organizational inertia. But the fact that a company is even attempting this – suggests the market is finally ready for a reckoning with the vendor lock-in model.

In biotech, that’s progress.

Key takeaways:

- Vendor lock-in costs labs millions in lost flexibility and hidden integration expenses – something rarely quantified in the industry press.

- QB Systems’ modular architecture directly solves the three major bioprocess pain points: integration complexity, data fragmentation, and initial capital investment.

- The economics work: hardware reusability across configurations, lower entry cost, and flexible licensing create a different value proposition than incumbents.

- Regulatory compliance is built-in, not an upgrade – critical for labs that operate in regulated environments.

- This is about democratizing biotech automation, not just offering another competing product. The modular approach levels the playing field for startups and mid-market firms that historically had to choose between capability and budget.