Peptides are no longer confined to the margins of biomedical research. Once viewed primarily as niche tools for probing biological pathways or as incremental drug candidates, peptides and related biomolecules are now emerging as a central pillar of innovation across biotechnology, dermatology, metabolic medicine, and even consumer health. Recent advances in peptide biology are not only reshaping therapeutic pipelines but also challenging long-standing assumptions about where medicine ends and wellness begins.

Across academia and industry, a growing body of evidence suggests that peptide-based interventions may be capable of delivering clinically measurable benefits in areas such as skin regeneration, hair growth, metabolic regulation, and inflammatory control. Importantly, many of these findings are now being demonstrated in human studies rather than remaining confined to preclinical models. This shift is drawing increased attention from both biopharma developers and consumer health companies, as the boundaries between clinical therapeutics and wellness-oriented products continue to soften.

Why peptides are attracting renewed attention

Peptides occupy a unique position in the biological hierarchy. Larger than small molecules but smaller and structurally simpler than full-length proteins or monoclonal antibodies, they often combine favourable aspects of both. Many peptides can be designed to interact with highly specific biological targets, mimicking or modulating natural signalling molecules such as hormones, growth factors, or cytokines. At the same time, they are generally easier to synthesize, modify, and scale than complex biologics.

From a manufacturing perspective, this matters. Compared with monoclonal antibodies or cell-based therapies, peptides typically involve lower production costs, shorter development timelines, and fewer supply-chain constraints. Advances in solid-phase peptide synthesis, purification technologies, and formulation science have further reduced barriers to entry. For developers operating in increasingly cost-conscious markets, peptides offer a compelling balance between biological sophistication and economic feasibility.

Scientific understanding has also matured. Over the past decade, researchers have gained deeper insight into peptide stability, bioavailability, and delivery, addressing issues that once limited their clinical potential. Chemical modifications, conjugation strategies, and novel delivery systems have helped extend half-life, improve tissue penetration, and reduce degradation. As a result, peptides are now being considered not only as injectable drugs but also as topical, oral, and transdermal interventions.

From laboratory signals to human data

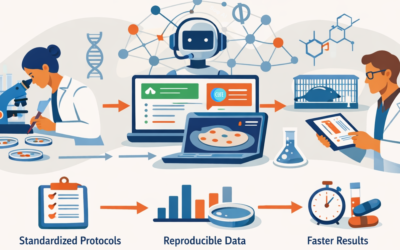

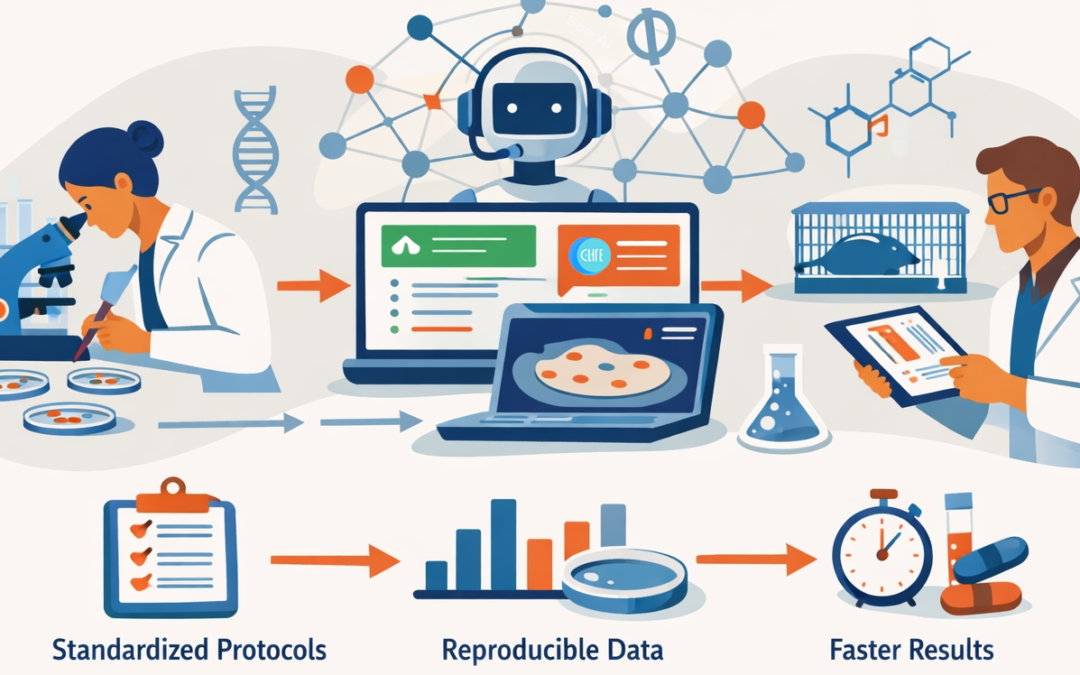

One of the most important developments in the current peptide renaissance is the growing availability of data from human cohorts. Historically, enthusiasm for peptide-based approaches has often been tempered by the gap between promising laboratory results and inconsistent clinical outcomes. That gap is beginning to narrow.

In dermatology and hair biology, for example, recent human studies have reported measurable improvements in parameters such as hair density, hair thickness, and skin quality following treatment with specific peptide formulations. These effects are typically linked to pathways involved in follicular cycling, cellular proliferation, inflammation control, and extracellular matrix remodelling. While not all studies reach the rigor or scale of late-stage pharmaceutical trials, the accumulation of controlled human data is shifting perceptions of what peptides can realistically achieve.

Metabolic research is following a similar trajectory. Peptides that influence appetite regulation, insulin sensitivity, energy expenditure, and lipid metabolism are being explored not only for traditional indications such as obesity and type 2 diabetes but also for earlier-stage metabolic dysfunction. This has raised interest in whether certain peptide interventions could be deployed before overt disease develops, aligning with broader trends toward prevention and health optimization.

Crucially, the emergence of human data has implications beyond scientific validation. Regulators, investors, and commercial partners are far more likely to engage when biological effects are demonstrated in real-world populations. For peptide developers, this shift supports more credible translational pathways from discovery through to market-facing applications.

The convergence of biotech and consumer health

Perhaps the most striking aspect of current peptide research is its relevance across traditionally separate sectors. In areas such as skin, hair, and metabolic health, the same biological pathways are of interest to pharmaceutical companies, medical device manufacturers, and consumer wellness brands. This convergence is creating new strategic questions about product positioning, regulatory pathways, and long-term value.

On one end of the spectrum, peptides are being developed as prescription therapeutics aimed at clearly defined diseases. On the other, similar or related molecules are appearing in dermatology products, cosmeceuticals, and wellness formulations marketed directly to consumers. While regulatory standards and claims differ significantly between these categories, the underlying biology is often closely aligned.

For the life sciences industry, this crossover presents both opportunity and complexity. Companies with strong scientific foundations may find new revenue streams by extending validated biological mechanisms into adjacent markets. At the same time, they must navigate reputational and regulatory risks associated with consumer-facing applications. Maintaining scientific credibility while engaging broader audiences requires careful communication and robust evidence generation.

The growing interest in wellness-adjacent therapeutic markets also reflects changing consumer expectations. Patients and consumers alike are increasingly proactive about health, seeking interventions that improve quality of life rather than simply treating advanced disease. Peptides, with their roots in endogenous biology, are often perceived as more “natural” or targeted, a perception that resonates with these trends even if it does not always align neatly with regulatory definitions.

Implications for drug development and regulation

From a development standpoint, peptides challenge traditional drug development models. Their relative simplicity can accelerate early-stage research, but their dual relevance to clinical and consumer contexts raises questions about optimal development pathways. Decisions around indication selection, trial design, dosing strategies, and endpoints may differ depending on whether a peptide is ultimately positioned as a prescription therapy or a consumer health product.

Regulatory agencies are also adapting. While peptides intended as drugs follow established pharmaceutical frameworks, the increasing number of biomolecule-based products entering non-prescription markets is prompting closer scrutiny. Authorities must balance innovation with consumer protection, particularly where biological activity is clearly demonstrated. For developers, early engagement with regulators and clear differentiation between product categories is becoming increasingly important.

Another consideration is intellectual property. Because many peptides are derived from or closely resemble endogenous molecules, securing robust patent protection can be challenging. This places greater emphasis on formulation, delivery technology, manufacturing processes, and clinical data as sources of competitive advantage. Companies that can integrate peptide science with proprietary platforms may be better positioned to sustain long-term value.

Commercial strategy and investment interest

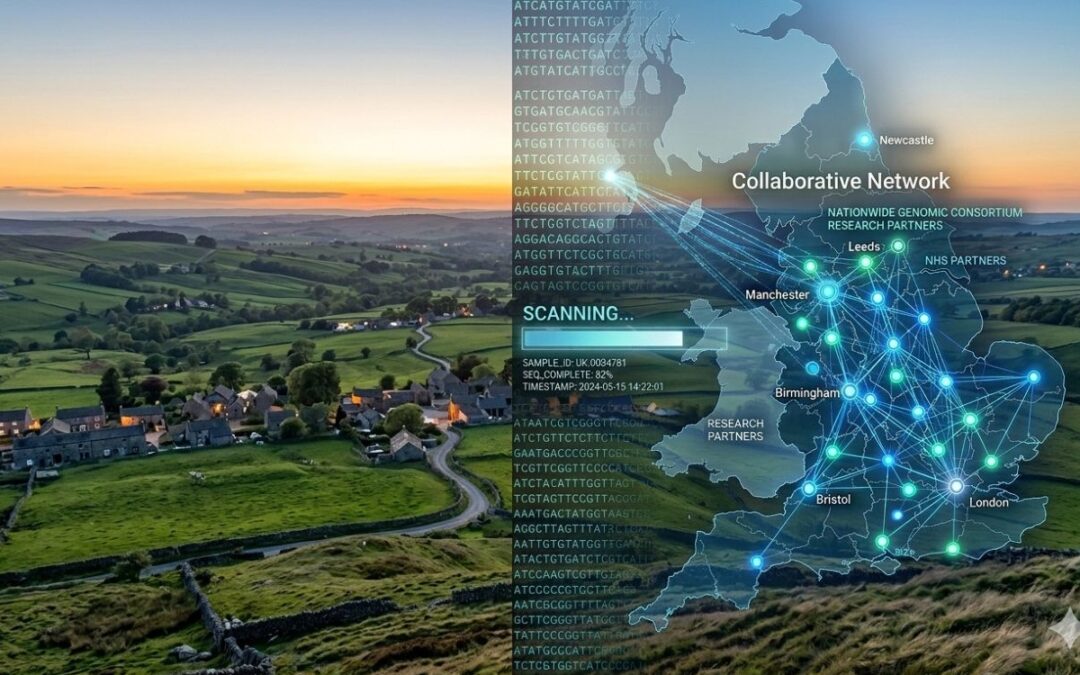

The commercial implications of peptide innovation are already visible. Investment activity in peptide-focused biotech companies has increased, supported by the perception that these molecules offer a favourable risk–reward profile compared with more complex modalities. Strategic partnerships between biotech firms and consumer health companies are also becoming more common, reflecting shared interest in biologically validated products with broad market appeal.

For established pharmaceutical companies, peptides can complement existing pipelines by addressing gaps in areas such as dermatology, metabolic disease, and inflammation. For startups, they offer a way to demonstrate tangible biological impact without the capital intensity associated with cell and gene therapies. In both cases, success depends on translating scientific promise into clear clinical or functional benefits.

Future outlook

Peptide and biomolecule research is entering a phase defined less by theoretical potential and more by measurable outcomes. As human data accumulates and manufacturing technologies continue to improve, peptides are increasingly viewed as practical tools for addressing both medical and quality-of-life challenges.

The blurring of boundaries between clinical therapeutics and consumer health is unlikely to reverse. Instead, it will require new frameworks for evidence generation, regulation, and communication. For the life sciences industry, this convergence offers a chance to rethink how innovation is delivered and who it ultimately serves.

What is clear is that peptides are no longer just incremental players in the drug development landscape. They are becoming a bridge between disciplines, markets, and expectations. In doing so, they are helping to redefine what biomedical innovation can look like in an era where health, wellness, and science are more interconnected than ever.