Johnson & Johnson has agreed to acquire Halda Therapeutics for $3.05 billion in cash, a transaction announced on 17 November 2025 and expected to close in the coming months, subject to customary regulatory approvals.

Halda’s Novel RIPTAC Modality

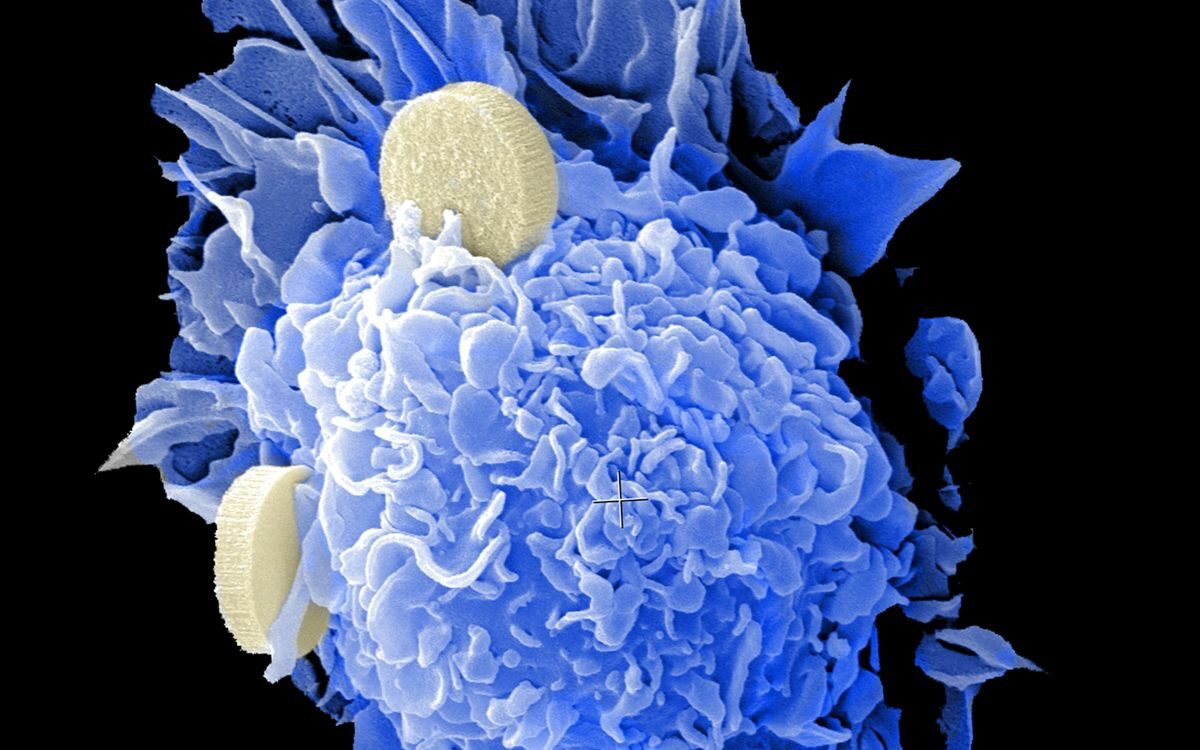

Halda Therapeutics is a clinical-stage biotech company based in New Haven, Connecticut, distinguished by its proprietary RIPTAC™ (Regulated Induced Proximity Targeting Chimera) platform. This technology uses a “hold-and-kill” mechanism: a RIPTAC molecule brings together a tumour-specific intracellular protein and an essential survival protein, forming a complex that selectively disables the latter in cancer cells, triggering their death. This strategy could overcome resistance mechanisms common to many existing precision oncology therapies.

Halda’s lead candidate, HLD-0915, is an oral RIPTAC therapy under investigation in a Phase 1/2 trial for metastatic, castration-resistant prostate cancer. Early clinical data show that it is well tolerated, lowers prostate-specific antigen (PSA) levels, and elicits partial tumour responses. Alongside this, Halda is developing RIPTAC programmes for solid tumours including breast cancer and lung cancer, aiming to broaden its therapeutic reach.

Strategic Rationale for J&J

For J&J, acquiring Halda is a strategic effort to expand its oncology pipeline. Jennifer Taubert, Executive Vice President and Worldwide Chair of Innovative Medicine at J&J, called HLD-0915

“an exciting lead asset in prostate cancer,” and emphasised the RIPTAC platform’s potential to fight “multiple cancers and diseases beyond oncology.”

John C. Reed, Executive Vice President of R&D, added:

“Many therapies lose effectiveness over time due to resistance. Halda’s innovative technology is designed to work even when cancers no longer respond to standard treatments.”

By incorporating Halda’s pipeline, J&J positions itself at the vanguard of next-generation oncology therapies. The goal is not just to treat but to transform how cancer resistance is managed.

Scientific and Clinical Challenges

The RIPTAC platform is promising, but it also comes with high scientific risk. The mechanism has not yet been validated in large-scale clinical trials, and long-term safety, dose optimisation, and durable efficacy remain key unknowns. Transferring this modality across different tumour types could face additional hurdles, such as variability in protein expression, tumour microenvironment, and drug delivery.

Moreover, the regulatory pathway for a novel class of bifunctional small molecules may be complex. Manufacturing these molecules at scale and securing approval likely pose significant technical and financial challenges. Effectively engaging with regulators such as the FDA’s Oncology Center of Excellence, which supports review and development of innovative cancer therapies, will be critical for advancing these programmes.

Financial Impact and Strategic Value

J&J anticipates a dilutive impact of approximately US $0.15 per share in adjusted earnings in 2026, largely due to short-term financing costs and equity grants for Halda employees. However, the company views this as a long-term investment in differentiated innovation. The acquisition supports J&J’s broader strategy of offsetting revenue risks from patent expiries through platform-based science.

For Halda’s existing investors — including prominent biotech funds — this deal represents strong validation of the RIPTAC technology. It offers clear scientific and commercial upside in a large oncology market.

Industry Trends and M&A Context

This deal reflects a broader pattern in the pharmaceutical industry: large companies are acquiring startups with platform technologies to refresh their pipelines. As patent cliffs loom, companies increasingly look toward innovative modalities such as RIPTAC, PROTACs, and other targeted degradation strategies that hold promise for durable cancer control.

Next Steps for J&J and Halda

Once the acquisition closes, J&J plans to accelerate the Phase 1/2 development of HLD-0915, while assessing other RIPTAC programmes in solid tumours. Its global R&D and manufacturing infrastructure is expected to support scale-up, potentially positioning RIPTAC as a cornerstone of J&J’s oncology innovation.

Broader Implications for Oncology

If clinically validated, RIPTAC could become a foundational technology in oncology, complementing or even outperforming other emerging modalities like PROTACs. The acquisition underscores a larger shift in drug discovery toward platform-based innovation, where companies harness modular technologies that can be deployed across multiple disease areas.

Conclusion

Johnson & Johnson’s acquisition of Halda Therapeutics is a clear signal of its commitment to next-generation cancer science. By integrating Halda’s RIPTAC platform, J&J is not simply investing in a promising molecule — it is backing a potentially paradigm-shifting therapeutic approach. While challenges remain, the deal could catalyse a new wave of targeted, resistance-resilient cancer treatments and cement J&J’s leadership in precision oncology.